- HOME

- Investor Information Top

- Corporate Governance

Corporate Governance

Basic stance on corporate governance

At the Sansha Electric Manufacturing Group, we practice management based on our corporate philosophy to achieve our purpose: Moving society forward through power electronics and creativity. We will also enhance our corporate value sustainably and contribute to the sustainable development of society by achieving our vision: Global Power Solution Partner. To achieve this, we have set ensuring compliance and building a highly transparent, efficient foundation of our business as our basic policies on corporate governance.

Corporate Philosophy

-

Valuable Products for Society

Make a continuous effort to create products that are sought by society and contribute to the development of society by providing products of better quality -

Profits and Prosperity for the Company

Always endeavor to raise awareness, aim for prosperity, secure profits and fulfill social responsibility for the Company -

Happiness and Stability for Employees

Always look to the future in high spirits and ensure happiness and a stable life for employees through trust and cooperation

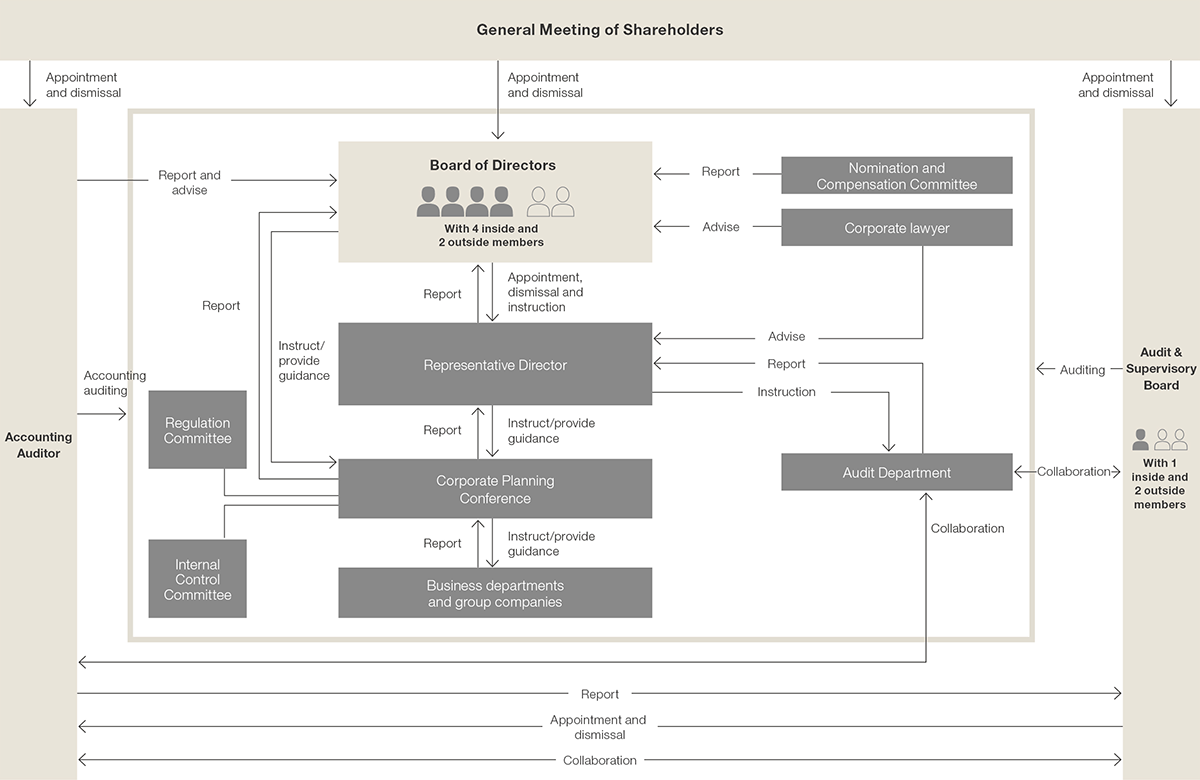

Corporate governance system

Corporate governance system

-

Board of Directors

The Board of Directors holds a regular meeting each month in principle and extraordinary meetings as needed. It makes decisions on basic management policies and important strategies. It is also defined as an organization that supervises business execution by Directors and Operating Officers. -

Audit & Supervisory Board

It holds a regular meeting each month in principle and extraordinary meetings as needed. In accordance with audit plans, Audit & Supervisory Board Members attend Board of Directors’ meetings and other important meetings, view significant documents and materials, visit and inspect principal facilities, and receive reports from Directors and other personnel on the execution of duties to audit the legality and appropriateness of the Directors’ execution of their duties. -

Nomination and Compensation Committee

It is chaired by an Outside Director, and a majority of its members must be Outside Directors. The content of its deliberations are reported to the Board of Directors. Deliberations on remuneration for officers are joined by an Outside Audit & Supervisory Board Member as an observer -

Corporate Planning Conference

It is attended by Inside Directors, Full-Time Audit & Supervisory Board Members, Operating Officers, presidents of subsidiaries based in Japan and the heads of relevant departments. It holds at least one meeting each month in principle. It makes advance deliberations on important business execution matters for which resolutions are set to be made at meetings of the Board of Directors. It also monitors the overall state of progress in the management plan and manages day-to-day actions such as solutions to problems. -

Regulation Committee

It is attended by Operating Officers and presidents of subsidiaries based in Japan.It discusses the creation of regulations and detailed rules as needed and delivers reports on important regulations to the Board of Directors. -

Internal Control Committee

It is chaired by the Director and the Executive General Manager of the Corporate Planning Division and attended by Inside Directors, Operating Officers, presidents of subsidiaries based in Japan and heads of relevant departments. It holds at least one meeting each month in principle. It provides overall control and supervision of matters related to riskmanagement and compliance in the whole Group. -

Audits by auditors, internal audits, accounting audits

The Audit Department conducts internal audits to ensure that each department's operations are properly executed in accordance with internal regulations.Audit & Supervisory Board Members collaborate with the internal audit department, sharing information, and conducting an auditor's audit.We have appointed KPMG AZSA LLC as our accounting auditor under the Companies Act and as our audit firm for audits under the Financial Instruments and Exchange Act.Audit & Supervisory Board Members, the Audit Department and the Accounting Auditor hold reporting sessions regularly or as needed to exchange information and cooperate with each other.

Corporate governance system chart

Risk management

Basic stance

As the risks facing businesses are diversifying, the Group identifies the various risks involved in its businesses, constructs a management system for risk prevention and takes actions to minimize the impact of risks. Our basic stance is to respond swiftly and appropriately to respond under the authority of the management team when any risk becomes a reality.

Risk management system

The Group has established the Internal Control Committee chaired by the Director and Executive General Manager of the Corporate Planning Division. To manage and prevent risk, we are working to develop our emergency response capabilities to address emergency situations when they occur. We have established a system for reporting to the Board of Directors as appropriate. The committee discusses policies and specific measures to address risks that are presumed to be involved in the Group’s business activities and to instruct individual departments.

Compliance

Basic stance

We are convinced that the Group’s corporate value will be increased by developing a corporate culture that values compliance and by building sound business foundations as a company winning trust from society.

Compliance with the Sansha Electric Manufacturing Group Behavioral Charter

The corporate philosophy of the Sansha Electric Group is universal and contains the founding spirit of Sansha Electric. This corporate philosophy is the starting point of the action policy of the Sansha Electric Group.

The Sansha Electric Group is convinced that compliance with laws and regulations, improvement of corporate ethics, enhancement of management soundness through highly transparent business activities, and fulfillment of accountability to society will lead to increased corporate value.

The mission of the Sansha Electric Group is to create the products that society needs. No matter how the times may change, customer first is the starting point of our business, and customer satisfaction is the key to the continuous development of our company. We will contribute to the development of society together with our customers by thinking from their perspective and creating safe, reliable products.

The Sansha Electric Group practices “Monozukuri” by mobilizing the collective wisdom of all officers and employees. We strive for coexistence and co-prosperity with the global environment and local communities, while conducting fair and appropriate transactions on a global scale to earn the trust of society.

In order to realize the corporate philosophy of the Sansha Electric Group, we have established the “Sansha Electric Group Behavioral Charter” to constantly review our own business activities.

The Sansha Electric Manufacturing Group Behavioral Charter

- We contribute to the development of a sustainable society by developing and providing products and services that are useful to society.

- In response to the globalization of business activities, we engage in fair, transparent, and free competition and appropriate business transactions.

- We will proactively contribute to society and protect the global environment.

- We will disclose necessary information to society in a timely manner, engage in constructive dialogue with all stakeholders, and strive to maintain and develop relationships of trust.

- We will respect human rights and diversity, ensure a safe and comfortable working environment, and realize comfortable, relaxed and affluence.

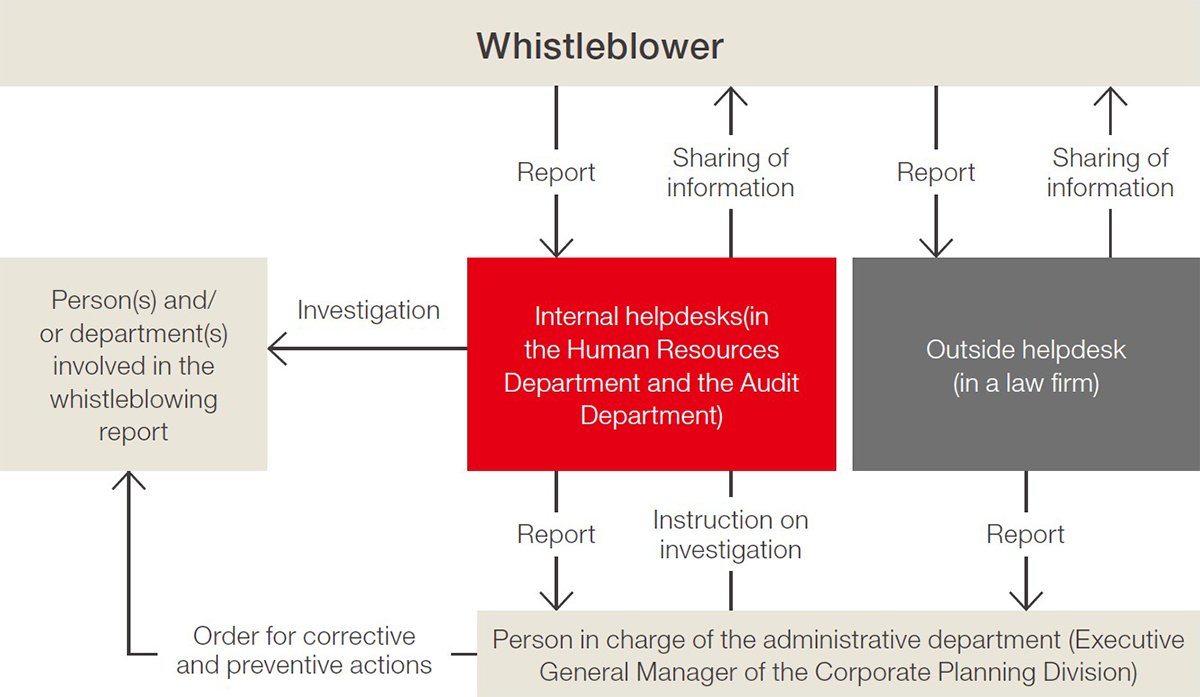

Whistleblowing system

The Group has set up compliance helpdesks (whistleblowing contacts) to be contacted by employees regarding inquiries about compliance and for the reporting of any dishonest conduct. In October 2021, an external law firm helpdesk was added and the helpdesk services became available in English and Chinese as well. Further, we have provided all employees of the Group with information about these helpdesks via a card which is distributed to the employees of the Group to carry with them, as well as internal groupware, training sessions, and other means of communication. Through these and other initiatives, we are striving to reinforce the helpdesk system and improve its reliability.

Upon inquiry or notification of any dishonest conduct, the Group will investigate the facts and take corrective and preventive actions. In accordance with the Whistleblower Protection Act and to thoroughly protect whistleblowers, the whistleblowing system prohibits the dismissal or any other disadvantageous treatment of a person for their whistleblowing.

Whistleblowing process flow

Information security

At the Sansha Electric Manufacturing Group, we understand that we have an important social responsibility to ensure the appropriate management of information, and we have established our Information Security Policy as described below to respond to trust of society as a whole, including our customers.

Information Security Policy

-

Compliance with laws, regulations and internal rules

We will comply with laws, regulations and other norms related to information security, establish rules on the handling of information assets and manage them appropriately. -

Information security management system

We will appoint a person responsible for the overall management of the entire Group’s information security and build an information security management system with a responsible person in place at each organization. Under this management system, we will implement information security measures to maintain and improve information security. -

Implementation of security measures

We will strive to implement information security measures which are appropriate for the changes in the business environment and business category, mainly reflecting the latest threats to information security, examples of attacks and vulnerabilities. If an information security incident should occur, we will respond to it promptly to minimize the damage and take measures to prevent its recurrence. -

Information security education and training

We will provide education and training needed to raise officers’ and employees’ awareness of information security. -

Continuous improvement

To check the effectiveness of our information security measures, we will conduct self-inspections or self-audits and strive to improve the measures continuously.

Officer remuneration system

The Board of Directors resolved at its meeting on 29 May 2023 on a policy for determining the amount of remuneration or the method of calculation of the amount of remuneration for directors and officers.

1.Basic stance

We have formulated a policy regarding the determination of remuneration for officers and the method for calculating it. It is as follows.

- The officer remuneration system must be intended to promote our continuous growth and medium- and long-term increase of our corporate value. It must encourage officers to perform their duties to their utmost abilities in accordance with our Group vision and to contribute to the improvement of financial results.

- On the basis of the data collected by outside research bodies, remuneration for officers will consist of base remuneration, which is a fixed amount for individual posts, and performancebased remuneration, to ensure that the sound incentives matched with the Directors’ duties will serve their intended functions.

- Remuneration for Outside Directors and for inside and outside Audit & Supervisory Board Members will consist solely of base remuneration, as they are independent from the execution of business and variable performancebased remuneration is not appropriate for them.

2.Stance on performancebased remuneration

The performance indicator for performance-based remuneration is consolidated operating profit ratio, chosen because it is the most important performance indicator related to the evaluation of performance during the fiscal year under review. We calculated performance-based remuneration by multiplying the standard amount for the specific post by the coefficient appropriate to the consolidated operating profit ratio. The amount of performance-Stance on performancebased remuneration based remuneration for Directors is discussed by the Nomination and Compensation Committee in accordance with the consolidated operating profit ratio for the fiscal year under review and reported to the Board of Directors. The Board of Directors determines the amount of performance-based remuneration for Directors in accordance with the report from the Nomination and Compensation Committee.

3.Matters regarding nonmonetary remuneration

The Company has introduced the performance-based stock compensation plan (hereafter, the “Plan”) as non-monetary remuneration. The purpose of the Plan is to increase Directors’ motivation to contribute to improved business results and enhanced corporate value in the medium and long term by further clarifying the link between Directors’ remuneration and the Company’s business performance and stock prices and having Directors share the benefits and risks of stock price fluctuations with shareholders. Points will be granted to each Director according to their position and the degree of achievement of performance targets, etc., based on the stock issuance rules established by the Board of Directors. In principle,the Company’s stock is granted to the Directors when they retire from office. Regarding the upper limit in the amount of money to be provided to the trust as a fund for the acquisition of stock, the initial period of the trust will be approx. four years, and under the Plan and during the period covered, the Company will offer up to 320 million yen, which is the amount of funds for the acquisition of stock necessary for granting the Company’s stock to Directors, as compensation for the Directors who are in office during the period covered. Regarding the upper limit for the granting of the Company’s stock to Directors, the total number of points allocated to Directors shall not exceed 40,000 points per fiscal year.

4.Matters regarding a resolution of the General Meeting of Shareholders on remuneration for officers and others

A resolution on monetary remuneration for Directors was passed at the ordinary General Meeting of Shareholders for the 74th term that took place on June 27, 2008, establishing an annual upper limit of 300 million yen, excluding the employee wages of any Director who is also an employee. Resolution on the monetary compensation for Audit & Supervisory Board Members was adopted by the ordinary General Meeting of Shareholders for the 59th term that took place on June 28, 1993 to set an annual upper limit of 40 million yen.

5.Matters regarding determination of remuneration for individual officers and others

Base remuneration for Directors for the fiscal year under review is the fixed remuneration for specific posts under the Regulations on Remuneration for Directors and has been discussed by the Nomination and Compensation Committee on the basis of officer remuneration data surveyed by an outside research body. The determination of remuneration for individual Directors is delegated to Hajimu Yoshimura as Representative Director & President, on the basis of the resolution of the Board of Directors. The Representative Director & President will determine remuneration in accordance the amounts of remuneration for individual Directors reported after deliberations by the Nomination and Compensation Committee within the limit on total remuneration in accordance with other resolutions that have been adopted at the General Meeting of Shareholders. The reason this duty has been delegated is that we believe the Representative Director & President can appropriately determine the remuneration for individual Directors in consideration of our overall financial results and other facts. The Nomination and Compensation Committee reviews the appropriateness of the determination of remuneration under the delegated authority prior to decisions coming into affect. Remuneration for Audit & Supervisory Board Members is determined through deliberation among them within the limit for the total remuneration for Audit & Supervisory Board Members as determined by a resolution passed at the General Meeting of Shareholders.